Retailers continue to operate in a rapidly changing and drastically challenging environment characterized by low supply and high demand. Agility and speed are key capabilities that help retailers deliver value to their customers. Due to continuously rolling impact of 2020 global COVID lockdowns, the business environment will require long time to stabilize.

Introduction:

Our retail industry trends analysis aims at identifying forces that shape retail today in their historical context, serving as a basis not only to observe current opportunities but also to predict short and long term future trends and potential strategies that may adapt businesses well to challenges of tomorrow.

Context:

2020 has been a turbulent year in the retail industry: following years of digital disruption, pushing retailers into an omni-channel model by brand competition on social media and the rising success of online commerce, retailers had to react quickly to adapt. In 2020 the rate of change for digitalization accelerated 10 times with the onset of COVID lockdowns world-wide. Having a strong online presence was no longer an option, it was mandatory.

Looking at how 2021 has gone to date and what may come in the near future, the business environment remains turbulent and rate of change remains high.

Digital disruption and the shock of 2020:

For several years now retailers have been under immense pressure from online competitors like Amazon who offered the convenience of home shopping with very competitive prices. This disruptive change in shopping behavior and the rise of social media has leveled the playing field geographically – being close was no longer a factor in online trade, as long as delivery was smooth and fast.

Traditional brick and mortar retailers have responded by heavily investing in online commerce capabilities, giving rise to omni-channel retailing that has proven to be an effective tool to counter competitive pressure from purely online players. Retailers who were slow to adapt broke under competitive pressure in the fight for customers, while more agile, nimble organizations who could introduce new capabilities, processes and ultimately value to their customers via services of convenience thrived.

Retailer bankruptcies have accelerated in pace during the past 24 months.

Then 2020 happened and the COVID pandemic has closed down the world in a matter of few weeks in the spring. Rate of change has accelerated 10 times in the broad adoption of online shopping in all sectors of retail world-wide. People got used to buying everything online, at most going to the store to do a curbside contactless pickup.

To make up for the social nature of shopping with friends in a store, online engagements centered more and more around social context and media – a trend that begun well before 2020 but also accelerated greatly in adoption during COVID lockdowns.

Online shopping on social media: influencers have become even more relevant at an accelerated pace during the COVID lockdowns of 2020, accelerating online growth of brands embracing social shopping.

Current retail trends:

In 2021, as stores are re-opening world-wide with a difference of a few months, customers are returning from COVID lockdowns and extended home school and home office work. A big open question about the future is how flexible remote working and remote school will be going forward, with mixed experiences to date. To attract talent and retain employees, business offer flexible work locations whenever possible. On the other hand governments, pressured by industry lobbies such as the restaurant and hospitality sector, are urging businesses to require workers back into offices, to fill city streets and service businesses in those cities with customers again. Also some companies have deemed it essential for their culture, efficiency and way of working for teams to be physically present together in office premises. It remains to be seen what the future of home office will be, with a most likely outcome of some kind of hybrid model.

As people return to on premise experiences, in store shopping is regaining its relevance. Although people are cautious, to date large increases have been seen world-wide in store footfall as COVID restrictions ease. Who is returning to stores first and in highest numbers differs by generational groups.

Primary shopping channels before, during and after COVID. Source: Shopify.

Resource shortages:

Despite generally improving global economic outlook and decreasing COVID infection levels, a number of grave challenges are impacting not only the retail industry but the entire global economy. During lockdowns of 2020 production and supply chain capacities were heavily impacted, resulting in a dramatic decrease in capacity.

Oil prices are a good indicator of economic activity level, which slowed to a record low pace in 2020 due to the impact of COVID lockdowns world-wide.

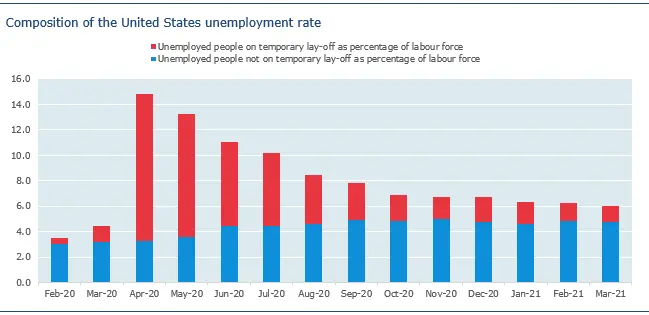

Many people lost their jobs in 2020, yet also a high number have found new jobs in ecommerce and related service industries.

Unemployment spiked in 2020, then people found new jobs as the year continued.

All this means that as the economy is beginning to recover broadly in 2021, production, supply chain and human capital capacities are missing or are slower to recover, causing a significant gap between demand and supply.

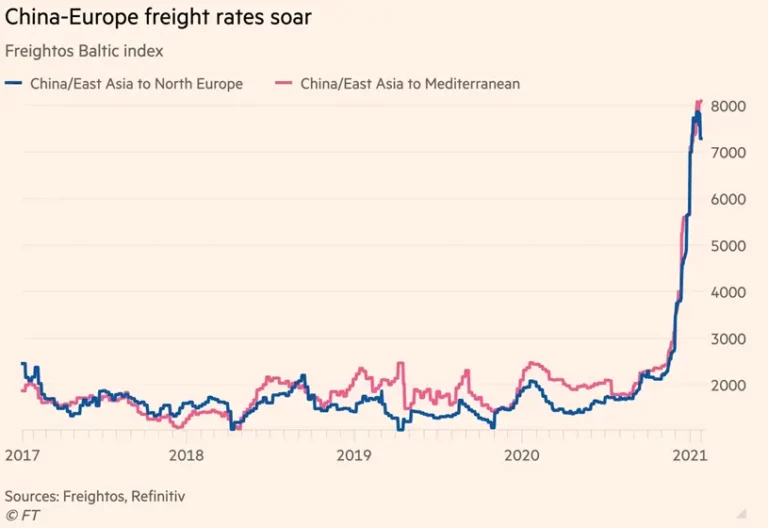

Supply chain capacity is overburdened by the global economic recovery and seasonal demand increase – the cost of shipping is skyrocketing in 2021.

Strategies deployed:

With the clear objective of retaining existing customers and winning new ones, retailers have been successfully deploying multiple strategies to win against competition. The most important strategy, as pointed out earlier, is to provide customers with a seamless omni-channel shopping experience.

Seamless omni-channel retailing:

Customers have gotten used to the convenience of online shopping in 2020. It is fast, easy, reliable and saves a lot of time. After COVID restrictions eased and customers started to shop in stores again, their heightened expectations of online convenience have transpired to the store experience. Overall customers have grown more impatient and more demanding for convenience and a hassle free, fast experience in the store.

Strategies aimed at increasing speed and convenience for customers, such as curbside pickup, showroom shopping and in store pickup have all been pioneered with outstanding results by innovating retailers, long before the pandemic. Learn how Target successfully implemented omnichannel processes before the pandemic. Capabilities for competing against online rivals are now mandatory to stay in business. Retailers who cannot engage with their customers seamlessly across all channels are quickly losing all of their customers, in the store and online.

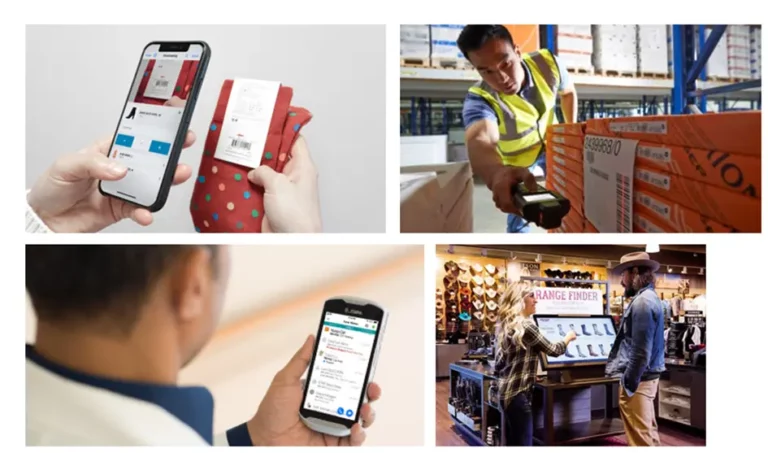

Customers today want the comfort, convenience, speed and efficiency of online shopping in the store. Fulfilling this expectation requires agility, accuracy and speed from retailers across all business units and channels.

Implementing omni-channel retailing successfully requires agility, accuracy and speed from retailers across all business units and channels. Processes and systems in place have to share information within the business, with partners and customers accurately and in real time.

Technologies supporting omni-channel retailing must be holistic, fast and accurate in order to orchestrate complex processes across the entire retail business and partners to fulfill customer expectations successfully.

Orchestrating logistics, supply chain, transportation, goods availability and suppliers for the timely delivery of goods is a complex task. It requires holistic solutions that are able to coordinate and orchestrate activities accurately and seamlessly in real time. Many different areas of the business are affected such as commerce, logistics, transportation, warehousing and stores simultaneously.

Real time transportation, logistics and supply chain management capability also helps retailers deal with resource capacity constraints that impact business globally today. Coordinating with logistics partners, manufacturers and transportation providers on continuously changing circumstances provides competitive agility to retail businesses. Such agility can secure goods for trade and deliver value to customers by providing them merchandise on time and on known budget.

Closer customer engagement:

Delivering value to customers beyond engaging on a seamless omnichannel model relies on leveraging data and insight both on an aggregated and individual level. Knowing your customers and knowing what, how and when they would like to engage with you on highly impresses them. Knowing your customers requires trust to solicit information and analytics capability to gain insight from the data you collect.

Knowing your customers requires trust to solicit information and analytics capability to gain insight from the data you collect.

Addressing customers in individualized communication with tailored and relevant offers increases revenue, margin and most importantly customer satisfaction. Missing on the opportunity to communicate in relevant and structured messages with customers not only leads to missed revenue opportunity, but may even cause anger with unsolicited messages that reflect no knowledge or interest in customer’s tastes, likes and needs.

A quick example of good customer segmentation and engagement is Home Depot’s Pro program, aimed at customers who are professional home builders. Home Depot realized that about 5% of their customers are actually professionals who buy high quality, expensive and durable tools often. Focusing on this group of customers and rewarding them with attractive offers has led to Home Depot gaining almost half (45%) of its total quarterly revenue from this group of customers alone. For more details please see Home Depot’s 2021 H2 earnings call transcript.

Outlook for the future:

Retailers are currently focusing on near term and mid/long term priorities, with most attention being paid to near term challenges around shortage of goods for the coming holiday season.

The business environment continues to be impacted by knock-on effects of the 2020 global COVID lockdown and will take more time to stabilize. Impact of 2020 pause in factory production, raw materials production and reallocation of labor force are all causing scarcity of resources today that require more time to catch up with quickly rebounding post pandemic demand.

Near term focus

Near term focus is on surviving 2021 holiday period with maximum revenue and profit with least damage to customer loyalty and trust.

To make the best of the 2021 holiday season, retailers are scrambling against short timelines to secure availability of goods in the stores for holiday trade against constrained capacities in manufacturing, transportation, logistics and labor force in all areas of the business. Real time supply, transportation, goods procurement and distribution orchestration solutions help make the most of what is available in terms of merchandise, transportation and labor capacity. Agile omnichannel ERPs are key part of making the best of this year’s holiday trade.

Long term focus

Long term focus is on anything beyond the 2021 holiday season. Due to the nature of current business challenges, little time and energy has been spent on anything beyond 2021.

Once retailers have dealt with current challenges, time will come to consider longer term objectives. Assuming seamless omnichannel capabilities are already adopted successfully, analytics and automation will continue to grow. Retailers plan to invest heavily into the ability to improve the efficiency of what they have in terms of merchandise, infrastructure and customers. Planning, modeling and optimizing solutions will be key in supporting these initiatives.

Cloud solutions play a big part in gaining key capabilities quickly. Leveraging AI will broaden the applicability of automation and process improvement. AI can make retailers more reactive at scale and with speed to ongoing changes.

Conclusion

Retailers continue to operate in a rapidly changing and drastically challenging environment characterized by low supply and high demand. Agility and speed are key capabilities that help retailers deliver value to their customers. Due to continuously rolling impact of 2020 global COVID lockdowns, the business environment will require long time to stabilize.

Questions? Contact us at:

You can download the original White Paper here: