Related Stories

Share this article

Table of Contents

Summary:

AI shopping agents are transforming retail by autonomously handling product discovery, comparison, and purchase workflows on behalf of consumers, promising greater convenience and efficiency. However, while industry narratives often suggest that these agents will commoditize retail – optimizing purely for price and specs and thus eroding brand loyalty – the emerging reality is more nuanced. Research and live deployments show that humans retain control by explicitly encoding brand preferences and values into their AI shopping agents, effectively making the human the true customer. The strategic imperative for retailers is therefore not just to build open APIs but to invest in Prompt-Mindset Optimization (PMO) – cultivating brand, community, exclusive products, and proprietary data that ensure customers actively instruct their AI agents to choose them.

AI Shoppers: A New Wave of Customers

The retail landscape is experiencing its most disruptive shift since the rise of ecommerce itself. But this time, the disruption isn’t coming from new retailers – it’s coming from a fundamentally different type of customer: artificial intelligence. As AI shopping agents evolve from experimental tools to production-ready systems, retailers face an urgent question that sounds straightforward but conceals a much more nuanced strategic reality: Who is the actual customer in agent-mediated commerce – the AI, or the human directing it?

The conventional answer from most industry analysis is clear: AI agents will optimize for price and specifications, killing brand loyalty and forcing a defensive technical race. But emerging evidence from deployed retail systems, consumer behavior research, and actual customer interactions with AI agents reveals a different, more complex picture. The true strategic battle isn’t for the machine’s optimization logic – it’s for the human’s prompt.

This distinction changes everything about how retailers should respond to agentic commerce. Rather than a universal race toward commodity APIs and headless commerce, the winning strategy appears to be Prompt-Mindset Optimization (PMO) – investing in brand, community, and authentic value such that when consumers instruct their AI agents, they specify your brand by name, overriding pure algorithmic optimization.

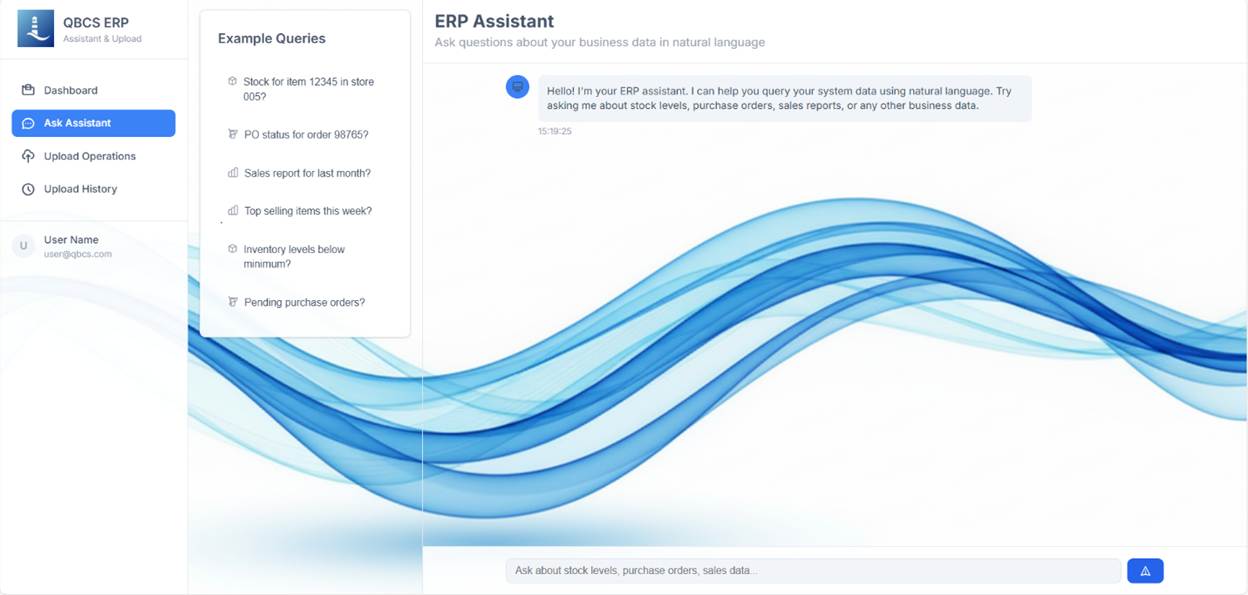

Image source: https://hbr.org/2025/10/what-should-retailers-do-about-ai-shoppers

The Rise of AI Shoppers: Understanding What's Actually Happening

Traditional retail has relied on a clear transaction flow: customers discover products through marketing and search, browse websites designed for human engagement, compare options, and make purchasing decisions. AI shopping agents are fundamentally rewriting this script – but perhaps not in the way most analysis suggests.

Modern AI agents – exemplified by OpenAI’s Atlas browser with Agent Mode and emerging shopping capabilities in ChatGPT – operate autonomously on behalf of consumers. These systems can interpret natural language intent, navigate multiple websites simultaneously, execute complex multi-step workflows, and complete purchases without immediate human intervention. A customer might say, “Find me running shoes under $150 with good arch support for marathon training,” and their AI agent handles discovery through checkout.

However – and this is critical – research on how consumers actually use these systems reveals something the commodity-optimization narrative misses: humans retain decision-making authority and routinely override their agents’ recommendations based on brand preference, values, and emotion.

AWS’s Global Head of Digital Commerce, Vince Koh, recently articulated this emerging reality: “The rise of AI agents is not erasing brand loyalty – it’s making it more explicit and measurable.” What this means: consumers are increasingly encoding their preferences directly into their agents’ parameters. Instead of agents making truly autonomous decisions, they’re executing human-defined value systems. A customer might instruct their agent: “Pay up to 10% more for sustainable products,” or “Always check Sephora first,” or “Find me Nike products that match my training goals.” The agent becomes a compliance mechanism for human preference, not an autonomous optimizer.

This distinction is profound. Research from Harvard Business School on AI-augmented decision-making shows that human judgment, experience, and values continue to drive final choices even in heavily automated contexts. Rather than eliminating brand loyalty, AI agents amplify it: customers whose agents are configured with brand preferences will consistently prefer those brands, and the AI will enforce that preference mathematically with perfect consistency.

The Two Competing Futures: Commoditization vs. Prompt-Driven Loyalty

The emergence of agentic commerce has created a bifurcated strategic landscape. Understanding these two futures is essential for positioning your organization correctly.

Future 1: The Commodity Model – Retailers feed open APIs to all external AI agents (ChatGPT, Google Shopping, Perplexity, Amazon), making products discoverable through any interface. Products compete primarily on price, specs, and ratings. Margins compress. Brand visibility comes entirely from algorithmic optimization. This path is viable but structurally unprofitable – a race-to-the-bottom where retailers become interchangeable suppliers.

Future 2: The Proprietary Enclave Model – Retailers build AI-powered experiences substantially superior to generic agents, leveraging proprietary data, exclusive products, integrated loyalty programs, and contextual intelligence. These brand-controlled agents surface what generic agents cannot: strategic alignment, exclusive benefits, and human values encoded into the customer’s original preference set. This path creates defensible competitive advantage.

The critical insight: most commoditized products (paper towels, generic coffee, standard batteries) will flow through generic agents to minimize friction and cost. But identity-driven, preference-based, or community-aligned purchases will remain locked into brand-controlled channels because the human actively wants it that way.

Research on Brand Loyalty in AI-First Retail supports this bifurcation: customers using brand-controlled AI agents (like Sephora Beauty Insider members with proprietary recommendations) show 2x higher spending and 3x higher engagement than customers using generic agent platforms. This isn’t because the AI is smarter – it’s because the customer preferred that experience and instructed the agent accordingly.

Real-World Implementations: Where the Market Stands Today

The question of whether retailers are actually investing in agentic commerce has an unambiguous answer: major retailers are already live with these systems, learning from early pilots, and preparing for massive scale. Critically, the most successful implementations share a common pattern: they prioritize proprietary customer relationships over open APIs.

Image source: https://www.techbrew.com/stories/2024/05/01/amazon-aws-q1-2024-earnings-ai-q

Amazon's Strategy: Proprietary vs. Federated Approaches

Amazon has positioned itself aggressively in agentic commerce with multiple concurrent initiatives, but with a revealing asymmetry. The company’s Rufus AI shopping assistant has achieved remarkable adoption: 250 million active customers used Rufus in 2025, with monthly active users increasing 140% and interactions surging 210% year-over-year. Critically, customers using Rufus during a shopping trip showed a 60% higher likelihood of completing a purchase.

The strategic insight here is subtle but critical: Rufus works better because it’s tuned to Amazon’s inventory, fulfillment capabilities, and customer data. It’s not that the algorithm is superior – it’s that Rufus has access to proprietary context (customer purchase history, loyalty status, real-time inventory) that external agents lack.

Meanwhile, Amazon’s “Buy for Me” feature allows agents to purchase from external sites, but Amazon controls the distribution layer. The company doesn’t give all agents equal access to its catalog. Instead, Rufus and Amazon’s proprietary agents are the primary discovery mechanisms, effectively creating a walled garden where Amazon’s inventory is privileged over competitors’.

This asymmetry reveals the emerging strategy: offer openness to external agents (for visibility) while simultaneously building proprietary experiences that are dramatically better (to capture loyalty).

Image source: https://www.ainvest.com/news/walmart-ai-super-agents-strategic-edge-commerce-revolution-2507/

Walmart's Bimodal Bet: Sparky and the "World Without Search Bars"

Walmart has taken a different but complementary approach, announcing an entire strategic framework of “super agents“ designed to create AI-mediated retail while also hedging toward proprietary advantage. The flagship is Sparky, a consumer agent built within the Walmart app that evolves continuously – from recommending products to autonomously performing complex shopping tasks. Early capabilities include reordering previous purchases, organizing events (like a “unicorn-themed party”), and analyzing refrigerator contents via computer vision to suggest recipes.

Walmart’s positioning is revealing, with CEO Doug McMillon explicitly stating the vision is “a world without search bars,” where customers simply describe their intent and Sparky orchestrates the entire journey. But critically, Sparky works better precisely because it has access to Walmart’s proprietary data (customer purchase history, inventory, loyalty status, local store operations). An external agent can’t replicate this contextual richness.

Simultaneously, Walmart announced a partnership with OpenAI in October 2025, allowing customers to shop Walmart through ChatGPT – a seemingly contradictory move toward openness. But this is actually a sophisticated hedge: participate in external agents while building a proprietary agent that’s so good customers prefer it. Research on Walmart’s positioning suggests the company is optimizing for a bifurcated market: commoditized basics flow through ChatGPT and generic agents (fine for low-margin items), while higher-engagement shopping happens through Sparky (where Walmart controls context and loyalty).

Image source: https://aiexpert.network/case-study-sephoras-ai-driven-store-of-the-future/

Sephora's Virtual Artist: The Proprietary Enclave Playbook

Sephora demonstrates the mature form of the proprietary enclave model. The company’s Virtual Artist – powered by ModiFace technology – isn’t just an AI agent; it’s a proprietary experience combining AR, computer vision, and AI into an omnichannel beauty advisory system. Real-time virtual try-ons across thousands of shades, AI-powered skin diagnostics, personalized recommendations based on skin tone and concerns – none of this is available through generic shopping agents.

The business impact reveals the true PMO advantage: Beauty Insider loyalty members spend 2x as much as non-members and visit Sephora’s digital platforms 3x more frequently. These customers aren’t just loyalists; they’re actively instructing their AI agents to shop Sephora first because they value the exclusive experience and benefits.

Sephora’s AI customer service agent handles order tracking, returns, and loyalty inquiries, saving 40+ hours per week in operations. But the real value is invisible: proprietary customer data from these interactions continuously improves recommendations, creating a flywheel that generic agents cannot replicate.

Image source: https://www.digitalsilk.com/digital-trends/nike-artificial-intelligence/

Nike's Proprietary Intelligence: The "Mixed Embeddings Model"

Nike built a generative AI-powered shopping assistant that demonstrates PMO in action. Rather than keyword search, Nike’s assistant engages users in conversation, learns their preferences iteratively, and improves recommendations with use. The system uses what Nike calls a “mixed embeddings model” that synthesizes three data sources: real-time conversation, member profile data, and enriched product catalog embeddings.

The personalization depth is revealing: the assistant recommends high-waisted, postpartum yoga pants in the customer’s preferred color to someone who recently purchased from Nike’s maternity collection. This isn’t generic optimization – it’s contextual intelligence powered by proprietary customer data.

Nike’s NikeAI within the Nike App handles conversational queries like “running shoes for a race” or “products in my favorite color and size,” making products discoverable through richer, more human search terms. The company simultaneously integrated Shopify AI tools into external channels, but the premium experience – the one customers prefer – lives in Nike’s proprietary ecosystem.

Image source: https://www.adweek.com/commerce/perplexity-officially-rolls-out-its-ai-powered-ecommerce-experience-in-the-us/

Perplexity and Google: Where Commodity Integration Meets Agent Fragmentation

Perplexity Shopping and Google’s AI Mode represent the commodity model in practice: shopping integrated directly into conversational AI and search experiences. Perplexity launched “Buy with Pro” enabling users to research and purchase within its interface using natural language. Google’s AI Mode in Search combines Gemini with its Shopping Graph (50+ billion product listings) to deliver dynamic results.

These platforms are optimizing for efficiency and reach, not loyalty. From a retailer’s perspective, being discoverable through these agents is essential but structurally low-margin. The advantage goes to the platform, not the merchant. However, this model creates an opening for premium brands: by being absent from generic agents and maintaining proprietary experiences, exclusive brands can signal scarcity and reinforce premium positioning.

Understanding the Shift: The Human Remains the True Customer

Here’s what the market is revealing that most analysis misses: the human defining the agent’s preferences is the true customer – not the AI executing the transaction.

Research on how humans interact with AI decision-support systems shows a consistent pattern: humans retain authority and override algorithmic recommendations based on values, identity, and emotion. A recent European Data Protection Supervisory study on human oversight of automated systems found that “in many decision-making contexts, humans do not passively accept automated recommendations but actively shape them based on personal values and context.“

This creates what AWS describes as “preference encoding“: customers translate their values into precise parameters their agents follow. Examples from early adopter research:

- “Find me sustainable products I’m willing to pay 10% premium for” – The human’s value preference overrides pure price optimization

- “Always check Sephora first for beauty products” – Brand loyalty encoded mathematically

- “Find me Nike running shoes for marathon training” – Identity and use-case preference embedded

When these preferences are encoded, the AI becomes a compliance mechanism for human values, not an autonomous optimizer.

Image source: https://www.hostinger.com/in/tutorials/how-to-design-websites-with-ai

How Websites and Retail Systems Will Actually Transform

The implications for website design are more subtle than the commodity narrative suggests. Rather than a universal pivot to API-centric, headless commerce – a single strategic approach for all retailers – the market is bifurcating into two architectural paradigms serving different strategic purposes.

The Commodity API Layer

For commoditized products competing primarily on price and availability, the headless commerce model makes sense: expose comprehensive, real-time APIs to all agents. This ensures basic visibility and participation in emerging channels. Structured data, real-time inventory, flexible checkout APIs, and loyal promotion data flow freely. Products compete on algorithmic optimization, margins compress, but reach expands.

This layer is necessary but strategically insufficient for building lasting competitive advantage. It’s table stakes, not differentiation.

The Proprietary Experience Layer

Simultaneously, retailers building proprietary agent ecosystems create fundamentally different architectures. Rather than exposing all data to external agents, these systems:

- Consolidate first-party customer data into a unified platform that feeds proprietary AI agents and loyalty programs

- Build context-rich personalization unavailable through generic agents – understanding not just what customers bought, but why, and what that reveals about future needs

- Create exclusive product access and loyalty benefits that external agents cannot surface

- Establish data governance that maintains customer relationships as proprietary assets, not commodities

Sephora’s architecture exemplifies this: the Virtual Artist combines proprietary AR technology, millions of virtual try-ons generating training data, Beauty Insider membership data, and exclusive product partnerships into an experience generic agents cannot replicate. The data layer stays proprietary; generic agents see only the output.

The Dual-Stack Reality

Most sophisticated retailers are building both layers simultaneously. Nike, for example, exposes basic product APIs to generic agents while also operating proprietary recommendation engines that are demonstrably superior. Amazon’s Rufus and Walmart’s Sparky represent this dual-stack: participate in external agent ecosystems while building proprietary experiences that command loyalty precisely because they work better.

This requires different investment approaches, different data governance, and different architectural thinking. But it’s becoming the baseline for enterprise retailers trying to win in agent-mediated commerce without sacrificing competitive positioning.

Image source: https://bernardmarr.com/how-to-develop-an-artificial-intelligence-strategy-9-things-every-business-must-include/

The Strategic Bifurcation: PMO vs. Commodity Competition

As agentic commerce matures, retail is splitting into two fundamentally different competitive landscapes, each requiring opposite strategic approaches.

Commodity Retail: Products with minimal differentiation (office supplies, batteries, generic groceries) will increasingly be mediated through generic AI agents. Competition will be price and availability. Margins will compress. Success requires operational excellence, supply chain efficiency, and cost control. Retailers who can compete effectively here – Amazon, Walmart, regional big-box retailers – thrive on scale, not brand.

Brand and Community Retail: Products where identity, values, or community matter (fashion, beauty, lifestyle, specialty goods) will remain disproportionately concentrated in brand-controlled channels. Why? Because when customers encode their preferences into their AI agents, they often choose to specify a brand by name, overriding pure optimization. A customer using a generic shopping agent might accept the cheapest running shoe. But a runner who identifies with Nike is more likely to instruct their agent: “Find me Nike products for marathon training,” explicitly preferring the brand to cheaper alternatives.

This bifurcation flips the conventional narrative. Rather than AI disintermediating brands, it’s re-cementing brand loyalty at a more explicit level. Customers encode their brand preferences mathematically into their agents, and those agents enforce those preferences with perfect consistency.

The vulnerability is real, but it’s not uniform. Mid-tier brands without premium positioning or operational excellence face the most risk. They can’t win on pure specs (outgunned by premium competitors) or pure price (outgunned by efficient competitors). They need to find non-traditional axes for differentiation: authenticity, sustainability, craftsmanship, community, local sourcing, verifiable transparency.

Strategic Imperatives: The PMO Playbook

For retailers and consultants advising enterprise clients, the strategic imperatives are fundamentally different than the “race to APIs” narrative suggests:

1. Build Your Proprietary Agent First (Before Opening Your APIs)

Rather than rushing to expose data to every third-party agent, invest in building a proprietary AI agent that’s demonstrably superior. Use it to perfect your app, loyalty program, and personalized experience. This agent becomes your competitive laboratory and your brand’s most direct customer relationship.

Amazon, Walmart, Nike, and Sephora all followed this pattern: proprietary agent first, external partnerships second. The reason: proprietary agents attract customers to your own channels, creating stronger data flywheels and higher lifetime value.

2. Recognize What Actually Competes on Commoditization

Not all products warrant proprietary treatment. Office supplies, batteries, generic groceries – these should expose open APIs to generic agents. The economics don’t justify proprietary investment. Focus proprietary resources on categories where:

- Brand preference and identity matter

- Community and loyalty drive repeat purchase

- Exclusive products or experiences exist

- Contextual intelligence creates measurable value

This bifurcated approach is what AWS and other platform leaders recommend: commodity APIs for commodity products, proprietary excellence for branded/premium categories.

3. Build Selective, Strategic APIs (Not Universal Openness)

Rather than indiscriminate openness, develop tiered API strategies:

- Tier 1 – Commoditized APIs: Feed basic product, pricing, inventory to all agents (buy visibility)

- Tier 2 – Strategic APIs: Offer deeper loyalty integration and exclusive product access to aligned agents (earn partnerships)

- Tier 3 – Proprietary Experience: Build brand-controlled agents with superior capabilities generic agents cannot match (create moats)

Amazon exemplifies this: basic data to external agents, proprietary context advantage to Rufus and internal systems.

4. Weaponize Your Exclusive Value

Identify your unique assets: exclusive products, proprietary data, unique service, community, expertise. Do not feed this to generic agents. Instead, use it to power your proprietary agent, creating experiences external agents cannot replicate.

Sephora’s 200+ million virtual try-ons represent proprietary training data that generic agents cannot access. This asymmetry is the competitive moat. Similarly, Nike’s proprietary understanding of athletic lifestyle, informed by millions of member profiles, feeds recommendations generic agents cannot match.

5. Encode Brand Into Customer Preferences (The PMO Strategy)

The highest-performing retailers are building brands so strong that customers explicitly instruct their AI agents to prefer them. This is PMO: Prompt-Mindset Optimization.

Instead of competing for algorithmic visibility, invest in brand positioning, community, content, and authentic customer relationships such that when customers define their agent’s preferences, they specify your brand by name. A Nike enthusiast instructing their agent “find me Nike running shoes” has made PMO work perfectly.

The shift in marketing: instead of optimizing for search rankings or generic agent visibility, optimize for being the subject of the human’s prompt. Build brand so strong, so aligned with customer values, so integrated into customer identity that customers actively prefer you regardless of algorithmic optimization.

Image source: https://www.axioshq.com/conclusion-generator

Conclusion: The Bifurcated Future - Where PMO Meets Commodity

The future of retail, while inherently unpredictable, is increasingly visible in the patterns already emerging from deployed systems. The outcome won’t be a universal conversion to API-centric commodity commerce. Instead, retail is bifurcating into two distinct competitive landscapes, each requiring opposite strategies.

Commodity categories – office supplies, batteries, generic groceries – will flow efficiently through generic AI agents. These retailers compete on cost, scale, and operational excellence. Margins compress. This is a race. Whoever controls supply chain efficiency and cost wins. Amazon, Walmart, and scaled regional players are well-positioned here.

But brand-driven, identity-rooted, and community-aligned categories will remain concentrated in proprietary channels. Why? Because when customers encode their preferences into their AI agents – which they increasingly do – many actively specify brand names, values, and exclusivity criteria. They tell their agent: “Shop Sephora first,” or “Find me Nike products,” or “I want sustainable brands with verifiable supply chains.” In these moments, human preference and brand loyalty triumph over algorithmic optimization.

This shift represents a subtle but profound reframing: AI agents aren’t replacing human agency – they’re amplifying and encoding it. The customer remains the true customer. The human writing the prompt remains the decision-maker. AI agents become tools for expressing human preference with perfect consistency.

For retailers, this means the strategic imperative isn’t a defensive “build APIs to avoid disintermediation.” Instead, it’s an offensive strategy: Build exceptional proprietary experiences that customers actively prefer, encode your brand so deeply into customer identity that they instruct their agents to choose you, and create data and operational advantages that generic agents cannot replicate.

This is PMO – Prompt-Mindset Optimization – and it represents the true competitive frontier in agent-mediated commerce. Retailers that win won’t be those that simply exposed their APIs most efficiently. They’ll be the companies that made their brands, communities, and experiences so compelling that customers explicitly told their AI agents to choose them. In doing so, they inverted the threat of disintermediation and turned agent-mediated commerce into a new source of competitive advantage – because the most sophisticated, most defensible competitive moat in the AI era is being the brand your customer actively chooses.